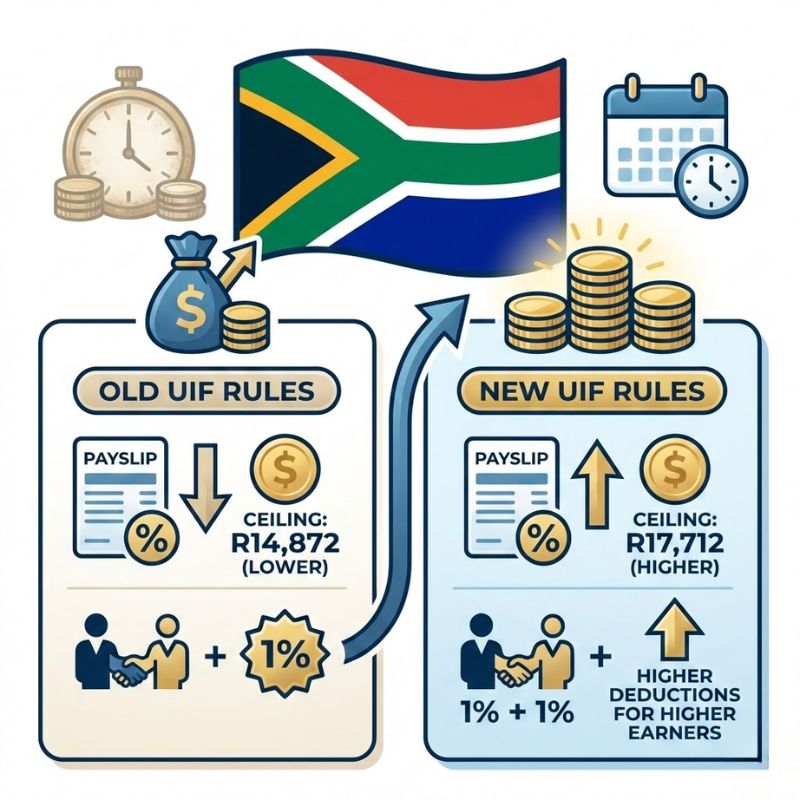

South African workers are entering a new chapter as the government revises the Unemployment Insurance Fund (UIF) framework. The updated contribution rates are designed to modernize the system, balance the fund’s sustainability, and better reflect current income patterns. For employees, this change mainly shows up on monthly payslips, where deductions may look slightly different from before. While the adjustment may seem small at first glance, it has broader implications for take-home pay, employer obligations, and future UIF benefits across South Africa’s workforce.

New UIF contribution rules and payroll changes

The revised UIF structure introduces updated contribution calculations that directly affect payroll processing. Employers will still deduct UIF monthly, but the way amounts are assessed has been refined to improve accuracy. For workers, this means adjusted deduction rates that align more closely with earnings, rather than outdated thresholds. The aim is to create fairer payroll treatment while ensuring the fund remains viable. Companies must also adapt their systems to comply with updated compliance rules, reducing errors and disputes. Overall, the shift encourages transparent salary calculations and helps employees clearly understand how much they contribute and why.

How UIF rate updates affect employee take-home pay

Any change to UIF contributions naturally raises questions about net salary. Under the new rules, some workers may notice a slight difference in deductions, depending on income levels. For many, the impact will be modest, but it reinforces the importance of accurate payslip reviews. The update supports income-based adjustments that prevent over- or under-contributing. Employees benefit from better benefit alignment, as contributions more accurately match potential claims. Over time, these refinements aim to protect long-term income security without placing unnecessary strain on monthly budgets.

Employer responsibilities under the updated UIF system

Employers play a central role in implementing the new UIF contribution rates. Beyond payroll deductions, they must ensure timely submissions and payments to authorities. The changes emphasize stronger reporting standards, pushing businesses to keep records accurate and up to date. Failure to comply could lead to penalties, making regulatory awareness essential. On the positive side, clearer rules simplify administration and promote consistent fund management. When employers follow the guidelines, employees gain confidence that their UIF contributions are correctly handled and protected.

What these UIF changes mean going forward

Looking ahead, the updated UIF contribution model signals a more sustainable approach to worker protection. By refining how deductions are calculated, the system supports future benefit stability while adapting to modern employment realities. Workers can expect clearer financial planning, as deductions are easier to predict and understand. Employers benefit from simplified payroll alignment, reducing confusion and errors. Ultimately, the reforms aim to strengthen trust in the UIF by ensuring it remains responsive, fair, and reliable for South Africa’s evolving workforce.

| Aspect | Old UIF Rules | New UIF Rules |

|---|---|---|

| Contribution basis | Fixed thresholds | Income-adjusted rates |

| Payslip clarity | Often unclear | More transparent |

| Employer reporting | Basic submissions | Enhanced accuracy |

| Long-term sustainability | Moderate | Improved stability |

Frequently Asked Questions (FAQs)

1. Who is affected by the new UIF rules?

All formally employed workers and their employers in South Africa are impacted.

Goodbye to Overlapping Grants: SASSA Enforces One Household One Grant Rule Starting 25 January 2026

Goodbye to Overlapping Grants: SASSA Enforces One Household One Grant Rule Starting 25 January 2026

2. Will everyone pay more UIF now?

Not necessarily, as deductions depend on individual income levels.

3. Do employers need to change payroll systems?

Yes, payroll systems may need updates to match the new contribution calculations.

4. When do the new UIF rates apply?

The rates apply from the official implementation date set by authorities.