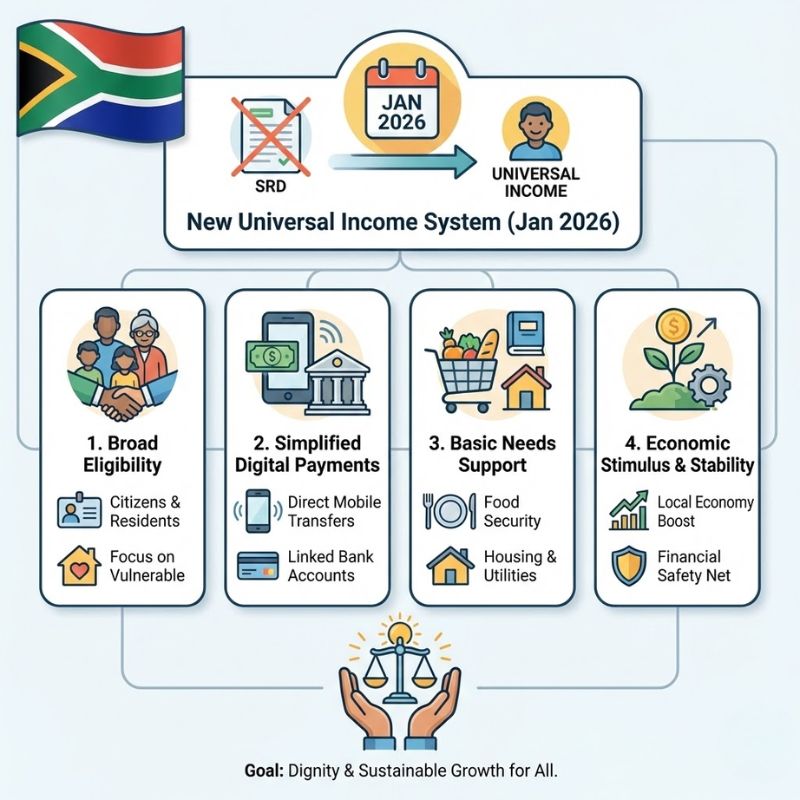

South Africa is entering a major shift in social welfare as the Universal Income Programme begins in January 2026, replacing the long-running Social Relief of Distress grant. The change aims to simplify support, expand coverage, and provide more predictable monthly assistance to low-income adults. As the SRD ends, many beneficiaries are asking how the new system works, who qualifies, and what payments will look like. This article breaks down the structure, goals, and practical impact of the new income support model.

Universal Income Programme launch and SRD transition

The rollout of the new programme marks a decisive move away from temporary relief toward a stable safety net. With SRD officially winding down, the government plans a smoother handover using existing beneficiary data. Officials say the focus is on income stability, reducing paperwork through automatic migration, and limiting delays via digital verification. Unlike SRD, which required frequent reapplications, the new system emphasizes continuous support for eligible adults. Payments are expected to follow a fixed monthly cycle, helping households plan better. This transition period is crucial, as authorities work to avoid gaps in support while upgrading systems and training staff across provinces.

How the new universal income system works

The Universal Income Programme is designed to be simpler and broader than previous grants. Eligibility will be assessed using means testing rules tied to income thresholds rather than employment status alone. Applicants will register once and remain enrolled unless their circumstances change, ensuring predictable payouts. The system relies heavily on bank-linked payments to reduce fraud and speed up transfers. For those without bank accounts, alternative channels will remain available, promoting financial inclusion. Overall, the structure aims to balance fiscal responsibility with reliable support for millions of adults.

SASSA Expands SRD Grant Access in 2026: Easier R350 Status Checks Via Online and WhatsApp Channels

SASSA Expands SRD Grant Access in 2026: Easier R350 Status Checks Via Online and WhatsApp Channels

Who benefits most from the universal income model

This programme primarily targets working-age adults who fall outside existing grants. Informal workers, jobseekers, and caregivers stand to gain from wider coverage that recognizes irregular incomes. By offering monthly assistance, the system helps smooth expenses like transport and food. Analysts also highlight economic resilience, noting that steady cash flow can stimulate local markets. For many households, the shift represents dignified support rather than emergency relief, signaling a long-term commitment to reducing poverty and inequality.

What this change means for South Africa

The end of SRD and start of universal income reflects a broader policy rethink. While funding pressures remain, supporters argue the programme offers policy continuity and better planning for both government and citizens. Critics caution about budget sustainability, but pilots suggest administrative savings over time. If implemented carefully, the reform could strengthen social protection and improve trust in public systems. Ultimately, success will depend on transparent management and ongoing evaluation to ensure long-term impact for vulnerable communities.

| Feature | SRD Grant | Universal Income Programme |

|---|---|---|

| Start Date | 2020 | January 2026 |

| Application Frequency | Repeated | One-time |

| Payment Cycle | Irregular | Monthly |

| Coverage | Limited adults | Broader low-income adults |

| Delivery Method | Mixed channels | Primarily bank-based |

Frequently Asked Questions (FAQs)

1. When does the Universal Income Programme start?

It officially begins in January 2026 across South Africa.

January 2026 SRD Grant Update: What SASSA Payment Timelines and Status Checks Mean for Applicants

January 2026 SRD Grant Update: What SASSA Payment Timelines and Status Checks Mean for Applicants

2. Will current SRD beneficiaries be re-applied?

Most will be transitioned automatically using existing records.

3. Is employment status required to qualify?

No, eligibility is mainly based on income thresholds.

4. How will payments be received?

Payments will be made monthly, mainly through bank-linked methods.