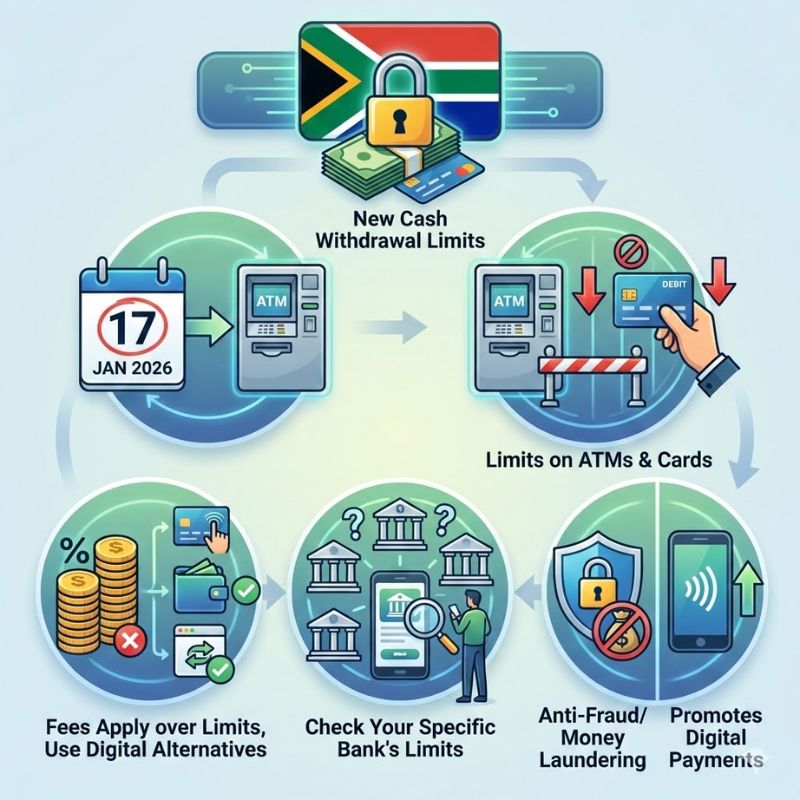

South Africa has introduced a nationwide cash withdrawal cap starting January 25, bringing noticeable changes for everyday banking users. The new rule affects how much money individuals can withdraw using ATMs and debit cards, aiming to improve cash management, reduce fraud risks, and encourage digital payments. For many South Africans, especially those who rely heavily on cash transactions, this policy marks an important shift in how daily finances are handled. Banks and customers alike are adjusting to the updated limits, which apply uniformly across the country.

South Africa cash withdrawal cap explained

The newly enforced cap places a ceiling on how much cash can be taken out within a set period, usually per day. According to banks, the change is designed to support financial stability goals, limit excessive cash handling, and improve ATM availability. Many customers will notice that repeated withdrawals may now be restricted once the threshold is reached. While digital payments remain unaffected, people who prefer physical cash may need to plan ahead. Banks have advised users to review their account settings and stay aware of daily withdrawal limits, bank policy updates, and transaction tracking tools to avoid declined transactions.

How ATM and debit card limits impact users

The impact of the new limits varies depending on spending habits. For urban users who frequently pay online or by card, the change may feel minimal. However, small traders and cash-dependent households could feel a stronger effect. Banks recommend spreading withdrawals across days or switching to electronic transfers where possible. The rule also helps reduce ATM cash shortages and supports fraud prevention measures. Customers should monitor account balance alerts and understand card usage rules to avoid inconvenience during urgent cash needs.

Why banks introduced the new withdrawal limits

Banks and regulators say the policy supports long-term efficiency in the financial system. Managing large volumes of cash is costly, and limits help reduce operational pressure. The cap also aligns with broader efforts toward digital payment growth and safer banking practices. By limiting large cash movements, institutions can better monitor unusual activity and strengthen consumer security standards. While some users may initially resist the change, banks believe it encourages smarter planning and greater use of secure cash alternatives and modern banking habits.

What this change means going forward

Looking ahead, the withdrawal cap signals a gradual shift in how money moves within South Africa’s economy. Cash will still play a role, but with clearer boundaries. Customers who adapt early by mixing cash use with digital options are likely to experience fewer disruptions. Over time, the policy may normalize lower cash dependence and improve service reliability. With long term efficiency, user awareness planning, regulated cash flow, and banking system resilience, the change could ultimately benefit both consumers and financial institutions.

| Withdrawal Type | Limit Basis | Applies To | Effective Date |

|---|---|---|---|

| ATM Withdrawal | Daily cap | All bank customers | January 25 |

| Debit Card Cash-Out | Per-day limit | Retail transactions | January 25 |

| Over-the-Counter | Bank-specific rules | Branch users | January 25 |

| Digital Payments | No cash cap | All users | Unaffected |

Frequently Asked Questions (FAQs)

1. When does the cash withdrawal cap start?

The new withdrawal limits take effect nationwide from January 25.

Goodbye to Overlapping Grants: SASSA Enforces One Household One Grant Rule Starting 25 January 2026

Goodbye to Overlapping Grants: SASSA Enforces One Household One Grant Rule Starting 25 January 2026

2. Does the rule apply to all banks?

Yes, all major banks in South Africa are required to follow the cap.

3. Are digital payments affected by this limit?

No, online and card payments remain unchanged.

4. Can banks set different limits?

Banks may vary limits slightly but must stay within regulatory guidelines.